Using the Fear and Greed Index in Forex Trading

The Fear and Greed Index, developed by CNN Business, is a valuable tool for assessing investor sentiment in the stock market. While it was originally designed for equities, the index can also provide insights for forex traders looking to gauge market psychology and potentially identify trading opportunities.

The index measures investor sentiment on a scale of 0 to 100, with 0 representing “Extreme Fear” and 100 representing “Extreme Greed.” A reading below 50 indicates a fear-driven market, while a reading above 50 suggests a greed-driven market. The index is calculated based on several factors, including stock price momentum, stock price strength, stock price breadth, put and call options, junk bond demand, and market volatility.

Correlating the Index with Currency Pairs

Studies have shown a correlation between the Fear and Greed Index and the performance of certain currency pairs, particularly those involving the US dollar. For example, when the index is in the “Greed” territory, indicating excessive optimism, the US dollar tends to weaken against other major currencies like the euro or Japanese yen. This is because when investors are feeling greedy, they are more likely to take on risk and invest in higher-yielding assets, which can put downward pressure on the dollar.

Conversely, when the index falls into the “Fear” zone, the dollar often strengthens as investors seek safe-haven assets. This is because when investors are feeling fearful, they tend to move their money into more stable and liquid assets, such as US Treasuries or the US dollar.

By monitoring the Fear and Greed Index and comparing it to the movements of your preferred currency pairs, you can gain a better understanding of the underlying sentiment driving the forex market. This information can help you make more informed trading decisions and potentially identify potential trend reversals or consolidation periods.

Using the Fear and Greed Index as a Contrarian Indicator

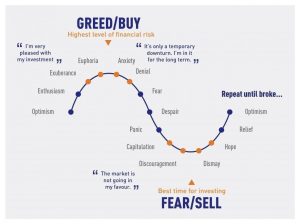

One way to utilize the Fear and Greed Index in your forex trading strategy is to use it as a contrarian indicator. The premise is that when the index reaches extreme levels of fear or greed, the market may be due for a reversal.

For example, if the index is in the “Extreme Greed” territory, it could suggest that the market is overbought and due for a correction. In this scenario, a forex trader might consider taking profits on long positions or even opening short positions, anticipating a pullback in the market.

Conversely, when the index falls into the “Extreme Fear” zone, it may indicate that the market is oversold and that a potential rebound is on the horizon. A forex trader might then look for opportunities to open long positions or hold onto existing positions, expecting the market to recover.

It’s important to note that the Fear and Greed Index is not a perfect predictor of market reversals, and extreme readings can sometimes persist for longer than expected. Therefore, it’s crucial to use the index in conjunction with other technical and fundamental analysis tools to confirm potential trading signals.

Combining the Index with Other Indicators

Some examples of how you can incorporate the Fear and Greed Index into your forex trading toolkit include:

1. Comparing the index with moving averages to confirm the strength and direction of trends.

For example, if the Fear and Greed Index is in the “Greed” territory and the currency pair is trading above its 200-day moving average, it could suggest a strong bullish trend.

2. Using the index to assess risk appetite and adjust your position sizing or risk management strategies accordingly. When the index is in the “Fear” zone, you may want to reduce your position sizes or increase your stop-loss levels to manage risk more effectively.

3. Analyzing divergences between the index and your preferred currency pairs to identify potential trend reversals or consolidation periods. For instance, if the Fear and Greed Index is making higher highs while the currency pair is making lower highs, it could signal a potential bullish reversal.

READ MORE:

Understanding Current Economic Landscape for Forex Traders

A Comprehensive Guide to Major Forex Pairs: Insights, Tips, and Trends

What is Trading Expectancy and how to implement this in your trading?

Conclusion

The Fear and Greed Index can be a valuable tool for forex traders looking to gauge market sentiment and potentially identify trading opportunities. By monitoring the index, correlating it with currency pair movements, and using it as a contrarian indicator, you can gain valuable insights into the psychology driving the forex market.

If you’re looking to take your forex trading to the next level, consider exploring the resources and educational materials available at ForexHero. With a focus on providing traders with the knowledge and tools they need to succeed, ForexHero can help you navigate the complexities of the forex market and develop a trading approach tailored to your goals and risk tolerance.