Understanding Current Economic Landscape for Forex Traders

In the ever-changing world of Forex trading, keeping a pulse on the global economic landscape is more important than ever. As of August 2024, the economic environment continues to be shaped by various factors such as GDP growth, inflation, and employment levels, all of which play crucial roles in influencing currency markets. In this blog, we will explore how the current economic conditions impact Forex trading and offer strategic insights to help traders navigate these complexities effectively.

Understanding the Economic Landscape

The economic landscape is a reflection of the global economy’s overall health. In 2024, this landscape is marked by moderate GDP growth, controlled inflation, and historically low unemployment rates in many advanced economies. However, challenges such as lingering inflationary pressures and geopolitical tensions continue to create uncertainties in the market.

Key Economic Indicators to Watch:

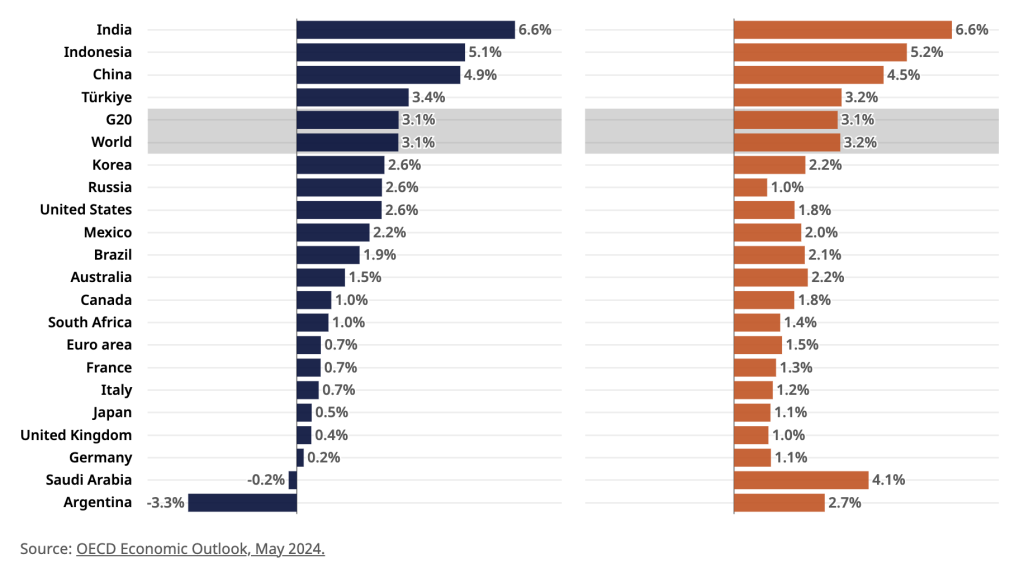

- GDP Growth: The global economy is expected to grow at a rate of 3.1% in 2024, with both advanced and emerging markets contributing to this steady pace. This growth, while modest, signals stability and presents opportunities for Forex traders to capitalize on currency movements.

- Inflation: Inflation rates have been on a downward trend throughout 2024, with headline inflation in major economies dropping faster than anticipated. However, underlying inflation, particularly in the services sector, remains elevated, which could influence future monetary policies.

- Unemployment Rates: As of mid-August 2024, unemployment rates in many advanced economies remain near record lows. This stability in the labor market supports consumer spending and economic growth, which are critical for maintaining currency strength.

Global Economic Resilience Amidst Challenges

The global economy in 2024 has shown remarkable resilience despite several headwinds, including tighter monetary policies and geopolitical conflicts. The ongoing impact of these challenges is particularly evident in sectors like housing and credit markets, yet overall economic activity remains robust. Inflation rates, which surged in the aftermath of the pandemic, are now receding more quickly than expected, bolstering private sector confidence.

Implications for Forex Traders:

- Currency Valuations: The resilience of the global economy suggests that currency valuations may remain stable, offering traders opportunities to engage in less volatile markets.

- Trading Opportunities: The faster-than-expected decline in inflation has prompted shifts in interest rate expectations, creating potential trading opportunities in currency pairs influenced by these changes.

Economic Growth and Inflation Trends

The global GDP growth rate is projected to be around 3.1% in 2024, continuing the trend of moderate growth seen in recent years. This growth is supported by strong economic performance in both advanced and emerging markets, despite ongoing geopolitical tensions and financial tightening.

Key Takeaways for Forex Traders:

- Monitor Growth Indicators: Keeping an eye on GDP growth rates can help traders anticipate shifts in market sentiment and currency strength.

- Adjust Trading Strategies: As economic conditions evolve, traders may need to fine-tune their strategies to align with the latest growth and inflation trends.

The Outlook on Unemployment

The labor market remains a pillar of strength in 2024, with unemployment rates continuing to hover near historic lows. This stability is a positive sign for the global economy, as it supports consumer confidence and spending, which are vital for economic growth and currency stability.

Impact on Forex Trading:

- Consumer Confidence: Stable employment levels bolster consumer spending, contributing to stronger economic growth and more stable currency markets.

- Market Volatility: Low unemployment rates can lead to reduced market volatility, offering a more predictable trading environment for Forex traders.

The Persistent Challenge of Inflation

While headline inflation has decreased across many economies, underlying inflationary pressures persist, particularly in the services sector. This suggests that while progress has been made, the path to achieving inflation targets may still be challenging and drawn out.

Strategies for Forex Traders:

- Monitor Inflation Trends: As inflation trends continue to influence central bank decisions on interest rates, Forex traders should stay vigilant and adjust their strategies accordingly.

- Trade Inflation News: News on inflation data can lead to significant market movements, providing opportunities for traders to capitalize on these shifts.

The Role of Artificial Intelligence in Shaping Economic Futures

Artificial intelligence (AI) continues to play a transformative role in driving productivity and innovation across various sectors in 2024. As AI becomes more integrated into trading platforms and financial services, its impact on the Forex market is becoming increasingly evident.

Leveraging AI in Forex Trading:

- Refine Trading Strategies: AI can help traders refine their strategies by providing advanced analytical tools and insights that were previously inaccessible.

- Enhance Analytical Capabilities: AI-driven tools can offer real-time market analysis, helping traders make informed decisions in a fast-paced market.

READ MORE:

- Mastering Forex Retracements: A Comprehensive Guide

- Mastering Swap Rates: A Comprehensive Guide for Forex Traders

- Mastering Forex Retracements: A Comprehensive Guide

ForexHero

As you navigate the complexities of the current economic landscape, having the right tools and resources is essential for success in Forex trading. ForexHero is designed to empower traders with advanced features like real-time analytics, AI-driven insights, and automated trading strategies. Whether you’re a novice or an experienced trader, ForexHero can help you make smarter, more informed decisions in the fast-paced Forex market.

Explore how ForexHero can enhance your trading experience and give you the edge you need to succeed. Visit ForexHero today to learn more and start your journey toward better trading outcomes.