Grid Trading Explained: A Simple Yet Powerful Forex Strategy

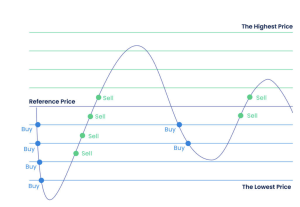

Grid trading is a popular strategy in the Forex market that capitalizes on price volatility by placing multiple buy and sell orders at predetermined intervals around a set price. This method allows traders to profit from both upward and downward price movements without needing to predict market direction.

If you’re looking to simplify your trading strategy while still gaining from market movements, you’ll want to master grid trading.

What is Grid Trading?

Grid trading is a systematic forex strategy that involves placing both buy and sell orders at predetermined price intervals around a central price. This approach is designed to capture market movements—whether the price goes up or down—without requiring traders to predict the market’s direction.

For instance, if a trader sets buy orders at 10-pip intervals above a set price, and sell orders below it, they can profit from any price movement, leveraging the market’s inherent volatility.

How Does Grid Trading Work?

Grid trading consists of setting up a series of buy and sell orders around a base price. Let’s break down the mechanics:

1. Order Placement: Traders place buy and sell orders at fixed intervals. For example, if the base price is 1.2000, buy orders may be placed at 1.2010, 1.2020, and so on, while sell orders are set at 1.1990, 1.1980, etc.

2. Market Movements: As prices move, the corresponding orders are triggered. A price increase will trigger buy orders, while a price decrease will activate sell orders. This allows traders to take advantage of both bullish and bearish trends.

3. Profit Realization: Traders close their positions when the price moves enough to reach predetermined take-profit levels. Risk is managed by setting stop-loss orders to minimize potential losses.

Types of Grid Trading Strategies

There are two primary types of grid trading strategies:

1. With-the-Trend Grid: Traders set buy orders above the current price and sell orders below it. This approach works well in trending markets, where prices are expected to continue in a particular direction.

2. Against-the-Trend Grid: Here, traders set buy orders below the current price and sell orders above it. This is ideal for ranging markets, where prices are expected to reverse within a certain range.

Advantages of Grid Trading

1. Simplicity: Grid trading doesn’t require you to predict market direction, which reduces the need for complex analysis.

2. Automation: The strategy can be easily automated, allowing traders to execute multiple trades without constant monitoring.

3. Profit Potential: By capturing profits from small price movements, grid trading can generate consistent results, especially in volatile or sideways markets.

Risks to consider when using the grid trading strategy in forex:

1. High Drawdown Risk

Grid trading can lead to significant drawdowns, especially if the market trends strongly in one direction without enough retracement. Without proper risk management, open positions may accumulate substantial losses, putting a trader’s capital at risk.

2. Market Volatility

While grid trading thrives on volatility, extreme market events or black swan events (e.g., economic crises, political instability) can cause rapid, unanticipated price movements, leading to sudden losses.

3. Over-Leveraging

Using excessive leverage in grid trading can magnify losses. Since multiple trades are opened simultaneously, traders may quickly exceed their margin limits, resulting in a margin call or forced liquidation.

4. Compounding Losses in a Trending Market

If the market trends in a single direction for an extended period, the grid of losing trades can grow significantly. Without a trend reversal, this leads to compounding losses, as more sell orders are triggered in a rising market or more buy orders in a falling market.

5. Complexity in Manual Management

While grid trading can be automated, manually managing open positions in a complex grid setup can be overwhelming. It requires constant monitoring and decision-making, especially when adjusting orders or closing positions.

6. Whipsaw Risk in Sideways Markets

In range-bound or choppy markets, prices may oscillate within a small range, triggering both buy and sell orders without significant profit potential. This “whipsaw” action can lead to small, frequent losses, eroding capital over time.

7. Risk of Over-Trading

Due to the high number of orders placed in a grid trading strategy, there’s a risk of over-trading, where too many trades are executed in a short period. This can result in higher transaction costs (spreads and commissions), eating into potential profits.

8. Psychological Stress

Managing a grid system can be mentally taxing, especially when multiple trades are open at the same time. Traders may find themselves second-guessing their decisions or abandoning their strategy under pressure during significant market swings.

By understanding and addressing these risks, traders can improve their grid trading strategy and enhance their ability to manage losses effectively.

How to Implement a Grid Trading Strategy

1. Choose a Currency Pair

Selecting the right currency pair is crucial to grid trading success. You should choose a pair that exhibits sufficient volatility, as this will create more opportunities for the grid to activate trades. Common currency pairs for grid trading include EUR/USD, GBP/USD, and USD/JPY.

Tip: Look for pairs that are experiencing temporary volatility but are expected to revert to a mean, as this will maximize the potential for price oscillations.

2. Define the Grid Size

Once you’ve selected your currency pair, the next step is to define your grid size. This means determining the intervals (in pips) between your buy and sell orders.

Smaller grid intervals (e.g., 10 pips) may trigger trades more frequently but yield smaller profits, while larger intervals (e.g., 50 pips) may result in fewer trades but larger profits per trade.

- Small Grid: Best for highly volatile or ranging markets, where prices oscillate within a narrow range.

- Large Grid: Suitable for trending markets, where prices are likely to move in a more defined direction.

3. Set Up Buy and Sell Orders

Once the grid is defined, you need to place buy orders above the current market price and sell orders below it. This structure ensures that whichever direction the market moves, your grid of orders will capitalize on price fluctuations.

Example:

- If the current price is 1.2000, you can place buy orders at 1.2010, 1.2020, and 1.2030, and sell orders at 1.1990, 1.1980, and 1.1970.

Each order should have a set take-profit and stop-loss level to lock in gains and limit potential losses. This risk management step is vital for long-term success.

4. Monitor and Adjust the Grid

Grid trading is not a “set it and forget it” strategy. You need to continuously monitor market conditions and adjust your grid accordingly.

For example, if the market suddenly becomes more volatile or enters a strong trend, you may need to widen or narrow the grid intervals, add more orders, or close unprofitable positions.

- Market Conditions: Be prepared to adjust the grid when the market transitions from ranging to trending, or vice versa.

- Order Size: Consider adjusting the size of each trade to ensure that your risk exposure remains balanced.

5. Risk Management

Effective risk management is critical when implementing a grid trading strategy. Since grid trading can expose you to multiple positions simultaneously, losses can accumulate if the market trends strongly in one direction without reversing.

- Set Stop-Losses: Each buy and sell order should have a clear stop-loss to limit your exposure.

- Position Sizing: Ensure that your position sizes are appropriate for your overall account balance and risk tolerance. Avoid over-leveraging, as this could amplify losses.

6. Automation for Consistent Performance

One of the key advantages of grid trading is that it can be automated, allowing traders to remove the emotional element from trading and focus purely on strategy execution. Automation ensures that your orders are placed exactly as planned, regardless of market conditions.

Automation is one of ForexHero’s standout features. With ForexHero’s advanced trading bots, you can set up a fully automated grid trading system. These bots can handle everything from placing orders to adjusting grid intervals, monitoring market movements, and executing stop-losses and take-profits. This ensures that you never miss an opportunity and helps you maintain consistent performance over time.

Example: Grid Trading in Action

Let’s assume a trader wants to apply a grid trading strategy on the EUR/USD pair with a starting price of 1.1800 and an interval of 20 pips:

- Buy Orders: Placed at 1.1820, 1.1840, 1.1860, etc.

- Sell Orders: Placed at 1.1780, 1.1760, 1.1740, etc.

As the market fluctuates, ForexHero’s automated bots execute these trades for you, ensuring you capture profits as prices rise and fall. The platform’s risk management tools ensure that each trade is placed with an appropriate stop-loss and take-profit level, safeguarding your capital.

READ MORE:

Using the Fear and Greed Index in Forex Trading

Setting Up DCA Trading Strategy in ForexHero

What Is Relative Strength Index (RSI)?

Conclusion

Grid trading is a versatile strategy that can be effective in various market conditions. While it offers several advantages, including simplicity and the potential for consistent profits, traders must be aware of the risks involved, particularly in trending markets. Proper risk management and a clear understanding of market dynamics are essential for successfully implementing a grid trading strategy in forex.

How ForexHero Simplifies Grid Trading

ForexHero makes implementing the grid trading strategy incredibly simple. With its automated trading bots, you can set up and execute grid strategies effortlessly. Traders can utilize pre-built templates or customize their own grid setups to match their preferences, without needing to constantly monitor the market.

For novice traders, ForexHero provides an intuitive interface, while experienced traders can take advantage of advanced features like position sizing and risk management tools. Grid trading is just one of the many strategies ForexHero can automate, allowing you to focus on analyzing market trends while your bots handle the heavy lifting.

Disclaimer

Any information provided in this article is not intended to be a substitute for professional advice from a financial advisor, accountant, or attorney. You should always seek the advice of a professional before making any financial decisions. You should evaluate your investment objectives, risk tolerance, and financial situation before making any investment decisions. Please be aware that investing involves risk, and you should always do your own research before making any investment decisions.